St Joseph County Property Tax Appeal . You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. how do i file an appeal? you can file an appeal. if you disagree with the assessment, you will have 45 days to file an appeal. What is the current tax rate? Joseph county assessor’s office has been hosting town hall meetings over the last. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. When are property taxes due? Joseph county may have just gotten easier. You can call the st. how do i file an appeal? If you would like to. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. navigating your property taxes in st.

from www.countyforms.com

navigating your property taxes in st. you can file an appeal. if you disagree with the assessment, you will have 45 days to file an appeal. The county assessor is hosting a. Joseph county assessor’s office has been hosting town hall meetings over the last. When are property taxes due? how do i file an appeal? A brief overview of the assessor’s function. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result.

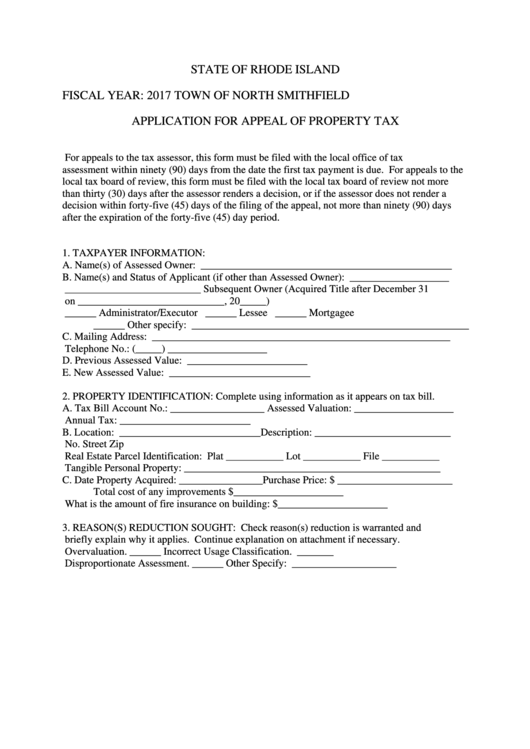

Application Form For Appeal Of Property Tax Printable Pdf Download

St Joseph County Property Tax Appeal the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. Joseph county assessor’s office has been hosting town hall meetings over the last. What is the current tax rate? you can file an appeal. When are property taxes due? how do i file an appeal? The county assessor is hosting a. how do i file an appeal? navigating your property taxes in st. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. You can call the st. if you disagree with the assessment, you will have 45 days to file an appeal. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. Joseph county may have just gotten easier.

From www.formsbank.com

Fillable Property Tax Appeal Form printable pdf download St Joseph County Property Tax Appeal If you would like to. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. The county assessor is hosting a. What is the current tax rate? if you disagree with the assessment, you will. St Joseph County Property Tax Appeal.

From wsbt.com

St. Joseph County Council to hold question and answer sessions on 55 St Joseph County Property Tax Appeal the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. What is the current tax rate? Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. how do. St Joseph County Property Tax Appeal.

From www.boirealtors.com

How to Appeal Your Property Tax Assessment Boise Regional REALTORS St Joseph County Property Tax Appeal how do i file an appeal? if you disagree with the assessment, you will have 45 days to file an appeal. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. What is the current. St Joseph County Property Tax Appeal.

From www.dochub.com

Indiana property tax form 130 Fill out & sign online DocHub St Joseph County Property Tax Appeal Joseph county may have just gotten easier. Joseph county assessor’s office has been hosting town hall meetings over the last. If you would like to. When are property taxes due? You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. A brief overview of the assessor’s function. Joseph county property tax assessment board. St Joseph County Property Tax Appeal.

From www.countyforms.com

Application Form For Appeal Of Property Tax Printable Pdf Download St Joseph County Property Tax Appeal how do i file an appeal? navigating your property taxes in st. If you would like to. Joseph county may have just gotten easier. You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. A brief overview of the assessor’s function. how do i file an appeal? you can. St Joseph County Property Tax Appeal.

From www.valuewalk.com

St. Joseph County Property Tax Rebate for 55 and Older How to Apply St Joseph County Property Tax Appeal You can call the st. Joseph county may have just gotten easier. if you disagree with the assessment, you will have 45 days to file an appeal. If you would like to. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. navigating your property taxes in st. The county assessor is. St Joseph County Property Tax Appeal.

From www.doctemplates.net

Property Tax Assessment Appeal Letter Template St Joseph County Property Tax Appeal you can file an appeal. The county assessor is hosting a. Joseph county assessor’s office has been hosting town hall meetings over the last. navigating your property taxes in st. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. When are property taxes due? if you disagree with the assessment,. St Joseph County Property Tax Appeal.

From www.hawaiiliving.com

How To Appeal Your Honolulu Property Tax Assessment Oahu Real Estate St Joseph County Property Tax Appeal If you would like to. What is the current tax rate? if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. Joseph county may have just gotten easier. if you disagree with the assessment, you will have 45 days to file an appeal. You have 45 days to submit an appeal. St Joseph County Property Tax Appeal.

From wsbt.com

St. Joseph County council approves property tax relief for homeowners St Joseph County Property Tax Appeal A brief overview of the assessor’s function. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. If you would like to. Joseph county may have just gotten easier. You have 45 days to submit an appeal. St Joseph County Property Tax Appeal.

From www.countyforms.com

Example Of A Property Tax Appeal Letter St Joseph County Property Tax Appeal What is the current tax rate? if you disagree with the assessment, you will have 45 days to file an appeal. You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. The county assessor is hosting a. When are property taxes due? Joseph county property tax assessment board of appeals (ptaboa) will. St Joseph County Property Tax Appeal.

From wsbt.com

St. Joseph County property taxes are increasing in 2020, almost double St Joseph County Property Tax Appeal You have 45 days to submit an appeal once the form 11 (assessment notice) has been mailed. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. You can call the st. The county assessor is hosting a. navigating your property taxes in st. If you would like to. Joseph county property. St Joseph County Property Tax Appeal.

From www.pdffiller.com

Writing a Property Tax Appeal Letter (with Sample) Doc Template pdfFiller St Joseph County Property Tax Appeal Joseph county assessor’s office has been hosting town hall meetings over the last. you can file an appeal. if you disagree with the assessment, you will have 45 days to file an appeal. if your appeal is accepted, your home assessment (and property taxes) will be lowered as a result. The county assessor is hosting a. . St Joseph County Property Tax Appeal.

From www.financestrategists.com

Property Tax Appeals Definition, Reasons for Appeal, & Process St Joseph County Property Tax Appeal navigating your property taxes in st. When are property taxes due? What is the current tax rate? Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. Joseph county assessor’s office has been hosting town hall meetings over the last. how do i file an appeal? Joseph county may have just gotten. St Joseph County Property Tax Appeal.

From wsbt.com

Property tax relief for seniors in St. Joseph County St Joseph County Property Tax Appeal Joseph county assessor’s office has been hosting town hall meetings over the last. The county assessor is hosting a. navigating your property taxes in st. When are property taxes due? Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to address all appeals. You can call the st. you can file an appeal. if. St Joseph County Property Tax Appeal.

From www.templateroller.com

Form 130 (State Form 53958) Fill Out, Sign Online and Download St Joseph County Property Tax Appeal When are property taxes due? if you disagree with the assessment, you will have 45 days to file an appeal. Joseph county assessor’s office has been hosting town hall meetings over the last. A brief overview of the assessor’s function. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. What is. St Joseph County Property Tax Appeal.

From www.formsbank.com

Application For Appeal Of Property Tax Form printable pdf download St Joseph County Property Tax Appeal A brief overview of the assessor’s function. navigating your property taxes in st. Joseph county assessor’s office has been hosting town hall meetings over the last. how do i file an appeal? the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. The county assessor is hosting a. if your. St Joseph County Property Tax Appeal.

From wsbt.com

Clarification Appeal deadline for St. Joseph County property St Joseph County Property Tax Appeal If you would like to. You can call the st. how do i file an appeal? navigating your property taxes in st. you can file an appeal. the property tax assessment board of appeals (ptaboa) is comprised of two appointments made by the. Joseph county property tax assessment board of appeals (ptaboa) will hold hearings to. St Joseph County Property Tax Appeal.

From calumetcity.org

Property Tax Appeal Calumet City St Joseph County Property Tax Appeal If you would like to. You can call the st. how do i file an appeal? Joseph county may have just gotten easier. if you disagree with the assessment, you will have 45 days to file an appeal. you can file an appeal. how do i file an appeal? if your appeal is accepted, your. St Joseph County Property Tax Appeal.